Irs 1040 Schedule C 2024 Instructions

-

admin

- 0

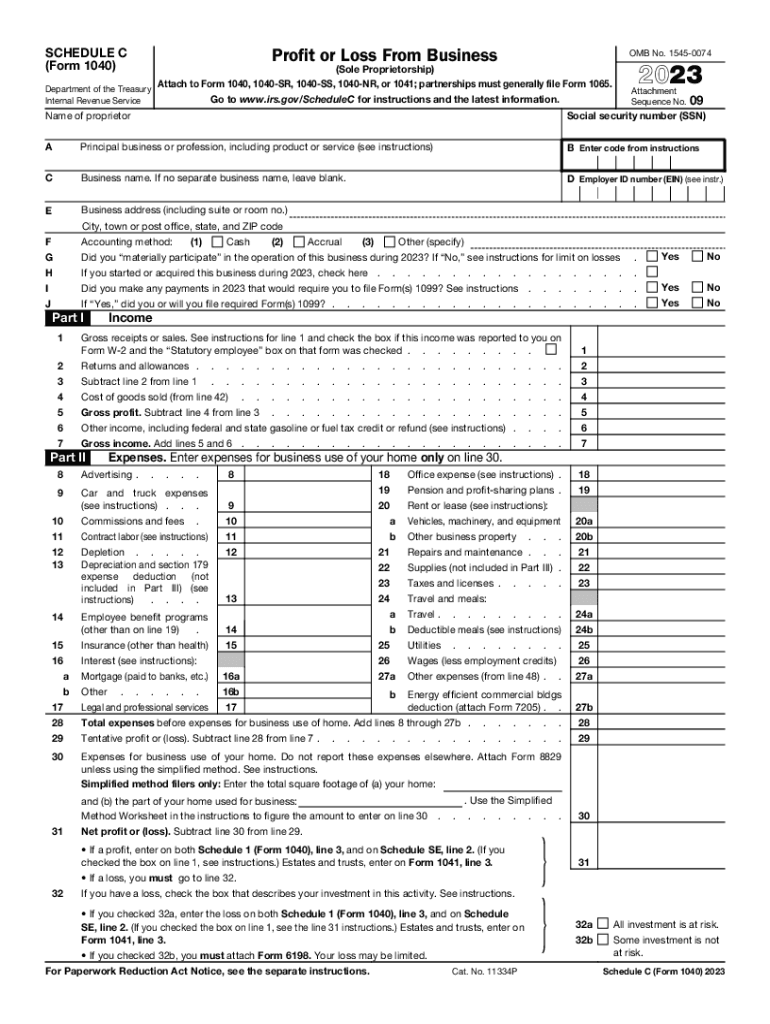

Irs 1040 Schedule C 2024 Instructions – When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C . A claimant must also fill out Schedule 8812, which is to be submitted alongside the 1040 document. The refund should be paid by February 2024 as the Internal Revenue Service cannot issue a payment .

Irs 1040 Schedule C 2024 Instructions

Source : www.irs.gov2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

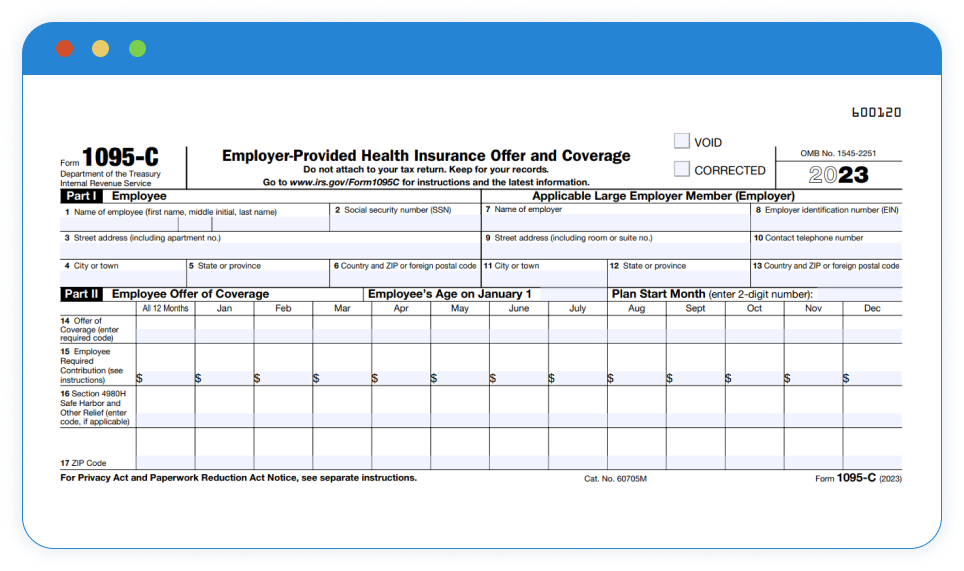

Source : www.kxan.comForm 1095 C Instruction 2024 | Step by Step 1095 C Instructions

Source : www.acawise.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Source : instruction-schedule-c.pdffiller.comHarbor Financial Announces IRS Tax Form 1040 Schedule C Instruct

Source : northeast.newschannelnebraska.comSchedule c form: Fill out & sign online | DocHub

Source : www.dochub.comAbout Schedule C (Form 1040), Profit or Loss from Business (Sole

Source : www.irs.govIrs 1040 Schedule C 2024 Instructions 2023 Instructions for Schedule C: The Internal Revenue Service (IRS) has released the Schedule 3 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY 3 tax form is part of the 1040 tax return. . Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss .

]]>